Roads

Arizona Department of Transportation crews are removing vegetation, grading the roadway and repairing drainage culverts to prepare for a project that will restore limited access to a stretch of State …

roads

The Arizona Department of Transportation advises drivers that ramp and lane restrictions originally scheduled to begin this month for a city of Mesa waterline project have been postponed until early …

Election 2024

Florence Mayor Tara Walter has officially announced her candidacy for Pinal County school superintendent.

The announcement was Walter’s first official declaration for the position, but it …

Roads

Apache Junction residents who missed a special open house earlier this month to discuss road maintenance in Pinal County now have an opportunity to take part in a virtual forum.

The event will …

Education

To get a 4-year-old child enrolled in kindergarten at Apache Junction Unified School District, parents will pay a new non-refundable $35 fee for the child to be screened to see if they are ready to …

Education

An Apache Junction charter school has the highest rating of high schools in the city on U.S. News and World Report’s annual best public high schools list.

Imagine Prep Superstition, 1843 …

Neighbors

Gold Canyon resident and military veteran Nancy Fassbender recently returned from a trip to Washington, D.C., where she and three other individuals represented Arizona and were in a National Vietnam …

First responders

The Apache Junction Police Department took the following reports of thefts and a burglary April 2-8:

Theft, reported at 8:28 a.m. April 3 in the 2500 block of East Bluff Spring Avenue.

…

First responders

The Pinal County Sheriff’s Office took the following reports of fraud and other incidents in Gold Canyon April 2-8:

Harassment/intimidation, reported at 2:51 p.m. April 2 in the 4700 …

Opinion

American wagyu is becoming known around the world as one of the top styles of beef. Due to its amazing marbling of fat, tenderness and unique flavor American wagyu beef is demanded by chefs all over …

Opinion

Properly disposing of important documents and electronics is an important security step for any business. Firms request the services of document shredding companies regularly and companies that do …

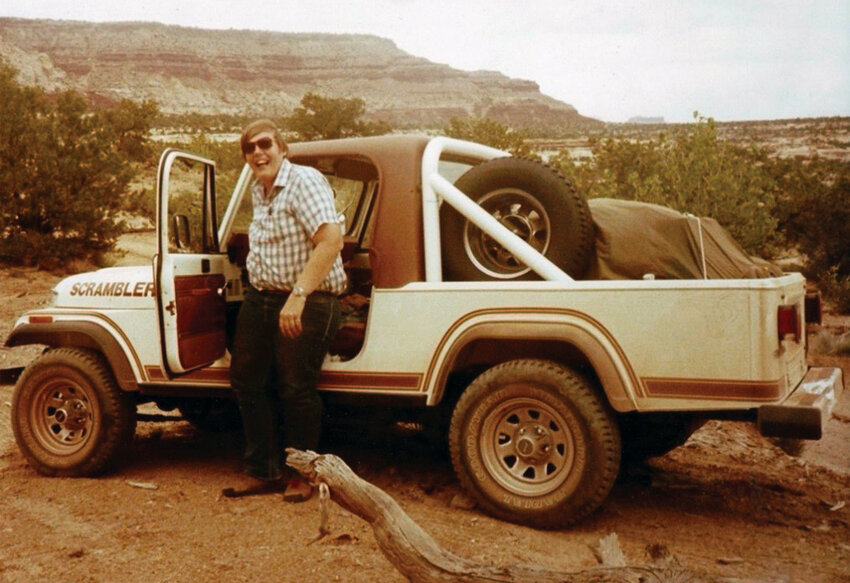

Richard “Ric” was born to Majorie Priscilla Schutt and John Elmer Smith October 24th, 1949 in Arlington Washington. He loved fishing and hunting in Washington’s Puget Sound area …

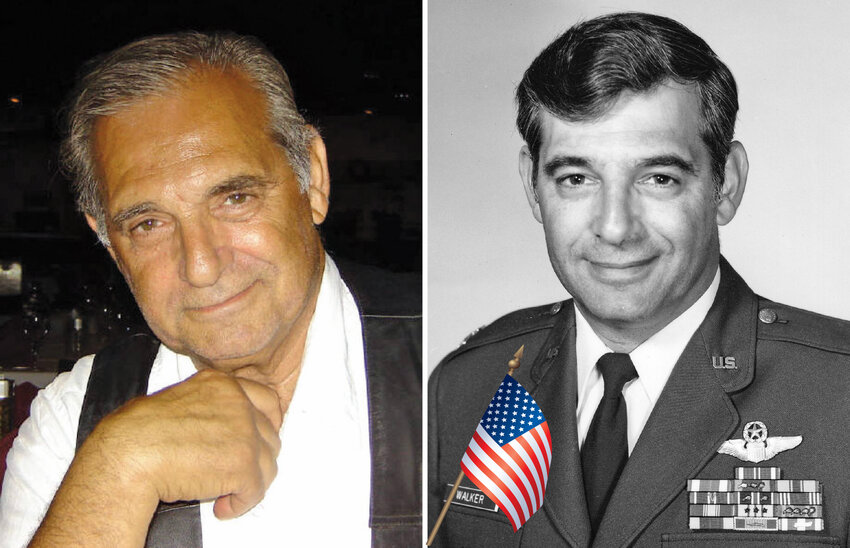

Colonel (Ret.) Thomas (Tom) E. Walker, a proud veteran of the United States Air Force, passed away March 22, 2024 at the age of 87 years. Tom resided in Apache Junction, Arizona with his late wife …

Opinion

Fires often occur when you least expect them. Ensuring your family’s safety must always be a top priority. Taking the right steps can reduce safety risks during fire emergencies in the home and …

Things to do

Join the Pinal County Parks and Trails Department Wednesday and Thursday in removing invasive plant species from Peralta Regional Park, 17975 Peralta Road in Gold Canyon.

Volunteers will be …

open burning

Pinal County Air Quality is only issuing three-day open burning permits, and officials announced all permits will expire by May 1.

Pinal County will suspend the issuance of all open burning …

Landfill

Residents of Apache Junction can throw out a load of trash at the landfill during “Free Dump Week” May 6-11.

During that week, the Apache Junction Landfill, 4050 S. Tomahawk Road, …

Permits

Out of a total of 161 building permits listed in Apache Junction for March 2024, there were a total of 98 issued as of April 16.

Examples of building permits filed, according to a website off of …

Read more