things to do

The Rhino ReCreation Center and Apache Junction library are hosting a chess tournament with prizes Saturday, April 20.

It is 10 a.m.-4 p.m. in the north wing program room at the library, 1177 N. …

Education

Central Arizona College will hold New Student Express Registration Days for the fall 2024 semester beginning later this month.

During the two-hour long, on campus, registration sessions, students will have the opportunity to meet one-on-one with an adviser, …

Things to do

Registration is open for Boys & Girls Clubs of the Valley’s summer camp programs designed to help working parents while ensuring that thousands of youth have a summer of exploration.

…

Neighbors

Sasha Nicholson, a Peralta Trail Elementary School educator in the Apache Junction Unified School District, was recently named the American Legion teacher of the year and honored at a reception along …

Wildfire risk reduction project

Starting Tuesday, April 16, the Arizona Department of Forestry and Fire Management in conjunction with Arizona State Parks and Trails and Superstition Fire and Medical District will conduct a one-day …

Government

Discussion or consideration of the city attorney’s employment, assignment or appointment is the one topic of the Apache Junction City Council’s April 15 closed-door executive session.

…

Country Thunder

The Pinal County Attorney’s Office was off and running on the first day of Country Thunder on Thursday by educating festival attendees about the dangers of drinking and driving.

By early …

Neighbors

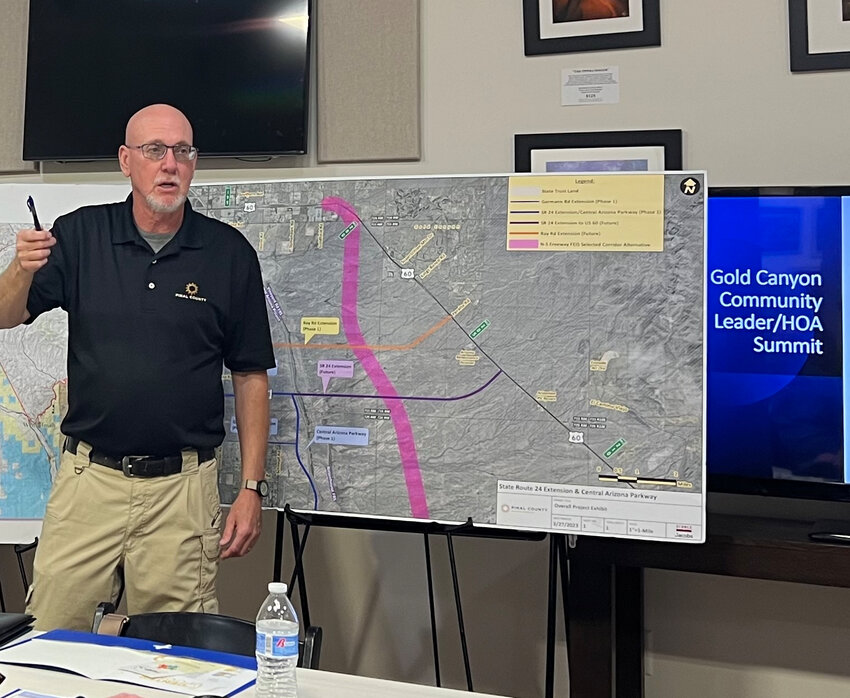

It was a full house at the new Gold Canyon Community Center on March 27. The attraction was the first-ever gathering of neighborhood leaders coming together to share interests, concerns and best …

Neighbors

Tiffany Hutchenson, a student at Apache Junction High School, has been awarded the prestigious 2024 Community Education (Arts) Scholarship.

The scholarship is granted to students who exhibit …

opinion

It’s that time of year again where your sinuses may realize everything is in bloom.

Allergies are the body’s reaction to a foreign protein it sees as an enemy. The result is your …

Things to do

The April Movie in the Park hosted by Apache Junction Parks & Recreation Department will be on Saturday, April 13, and will feature “Wall-E” on the big screen.

The feature film …

SUMMER PREPARATION

Pinal County Air Quality is only issuing three-day open burning permits, and officials announced all permits will expire by May 1.

Pinal County will suspend the issuance of all open burning …

Neighbors

Karen Banda and Rebecca Olivera have been named recipients of the "Women in Engineering Scholarship" at Central Arizona College.

They both credit Armineh Noravian, professor of engineering at …

DISTRICT 7 Senate

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State Senate District 7. District 7 includes Apache Junction, Gold Canyon, Payson, Show Low, …

DISTRICT 7 House

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State House District 7.

District 7 includes Apache Junction, Gold Canyon, Payson, Show Low, …

Housing subdivision

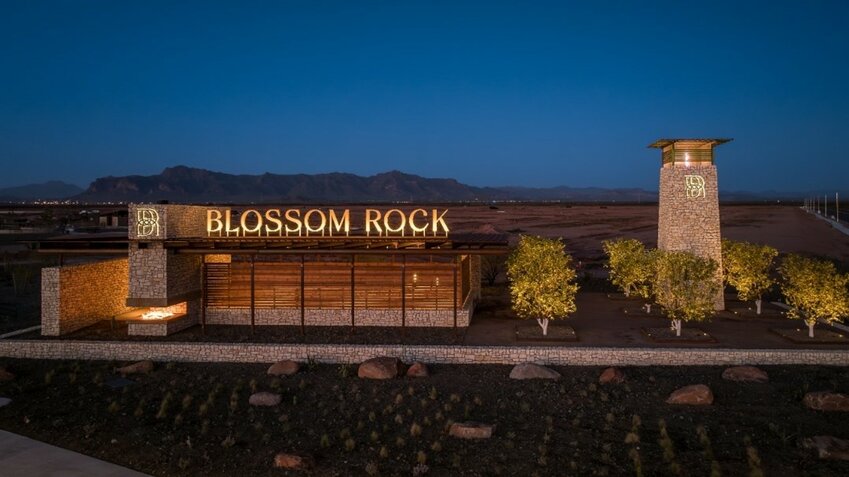

A block party will be held Saturday, April 27, at Blossom Rock at Superstition Vistas, a Brookfield Properties master-planned community in Apache Junction. Models and homes starting at $400,000 are …

Election 2024

Arizona's 16th legislative district is one of 30 in the state, consisting of sections of Maricopa, Pima and Pinal counties. It was created in January 2022.

Meet the 2024 LD 16 state …

Election 2024

Arizona's 16th legislative district is one of 30 in the state, consisting of sections of Maricopa, Pima and Pinal counties. It was created in January 2022.

Meet the 2024 LD 16 state senate …

Read more